Unlike employer-based health coverage which doesn’t pay for daily home care services, Long Term Care Insurance (LTC or LTCI), covers in-home care providers such as caregivers, nurse aides, personal care attendants and home health aides arranged through a Home Care Organization (HCO) that meets the insurance company’s requirements and follows their policies.

Medicare will cover a brief stay in a nursing home or provide the client with a limited amount of at-home care, but the conditions are extremely strict. With Long Term Care Insurance, seniors have more options regarding their health care needs – personal care services at home or admittance into a skilled nursing facility.

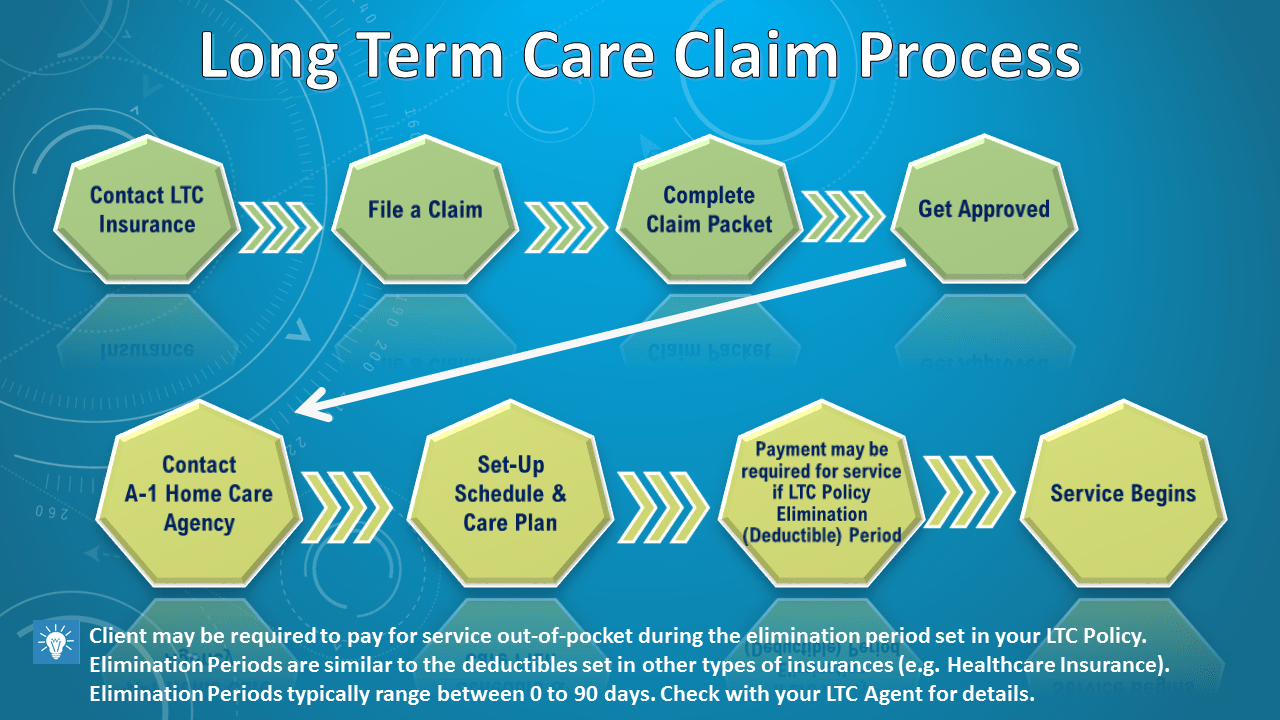

It’s extremely important that the policy holder or their family chooses a home care company or care facility that is knowledgeable about the specific requirements, forms and information that must be submitted correctly and on schedule to the insurance company. If these documents are not received by the insurance company, there may be an interruption in your care services.

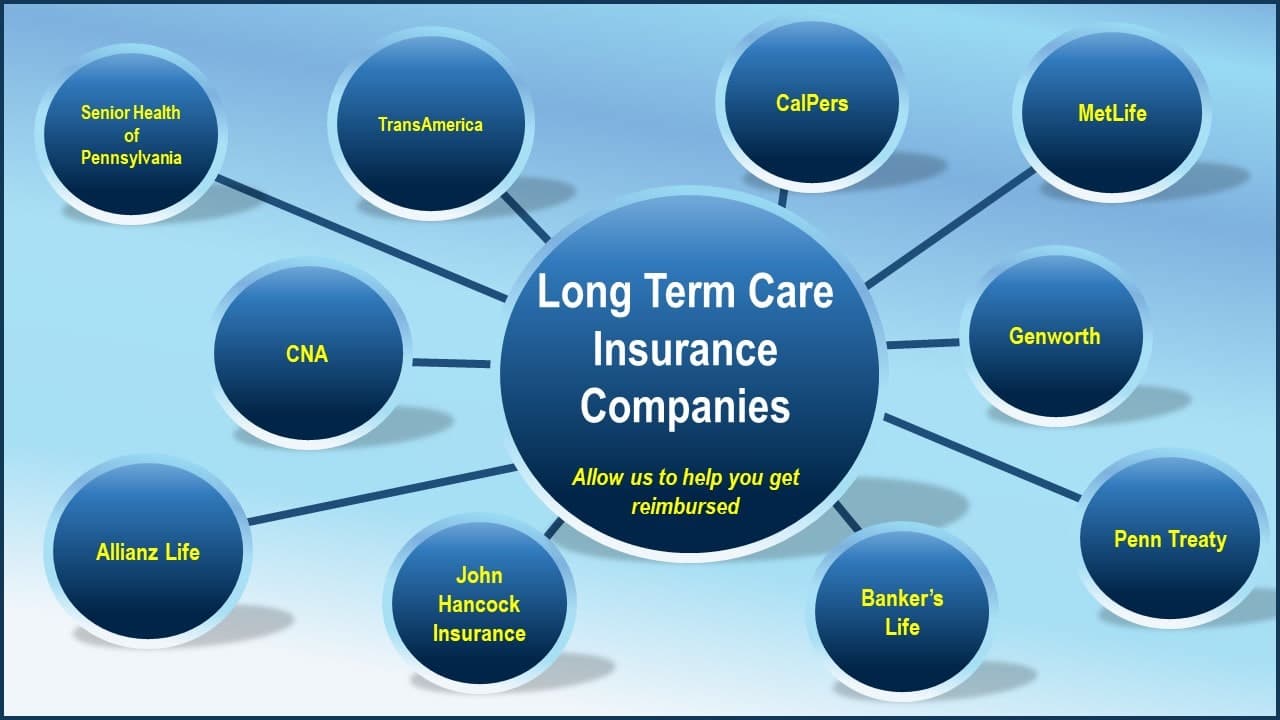

A-1 Home Care Agency has nearly 30 years’ experience working with Long Term Care Insurance Companies including:

We are recognized as a professional and reliable home care organization by these and many other insurance companies. Our Account Management Staff are knowledgeable about what documentation and procedures are required to ensure clients’ care is provided as scheduled. Clients can submit an Assignment of Benefits form which allows A-1 Home Care Agency to bill the insurance company directly. This eliminates your family from receiving invoices and making payments out of pocket and waiting for reimbursement from the insurance company.

We also maintain all records required by your long-term care insurance company and the IRS, allowing you to enjoy time with your family.

A-1 Home Care Agency is a State Licensed, Bonded and Insured Non-Medical Home Care Organization (HCO) helping seniors, elderly and disabled individuals living in Los Angeles County, Orange County and San Gabriel Valley.

We provide State-Certified Personal Care Assistants, Caregivers, Attendants, Nurse Aides and Home Health Aides to assist with:

Services Provided:

- Personal Hygiene Assistance

- Medication Reminders

- Mobility Assistance

- Range of Motion

- Errand Assistance

- Companionship

- Meal Preparation

- Assistance Recovering from Injuries, Accidents or Falls

- Bathing and Tuck-In Services (Certain Areas)

- Dementia and Memory Care

- Safety Supervision

- Alzheimer’s Disease

- After Surgery / Post-Acute Care

- After Stroke Recovery Care

- Parkinson’s Disease

- Cancer Caregiver Support

- Hospice Caregiver Assistance

- Care for Dialysis Clients

- Arthritis / Pain Management

- Disabilities and Special Needs

- Low Vision / Hearing Loss Assistance

In-home care allows your senior loved one to age gracefully in his or her home without the need to relocate to an assisted living facility or nursing home.

According to AARP:

“Depending on the policy options you select, long-term care insurance can help you pay for the care you need, whether you are living at home or in an assisted living facility or nursing home. The insurance might also pay expenses for adult day care, care coordination and other services. Some policies will even help pay costs associated with modifying your home so you can keep living in it safely.”

Depending on the options selected when purchasing a with Long Term Care Insurance policy, coverage for the following services/care arrangements may be available:

- Home Care Services

- Assisted Living

- Adult Day Care Services

- Nursing Homes

- Home Health Agency

- Visiting Nurse

- Home Modification

- Care Coordination

Important Factors to Keep in Mind

If you’re looking for long term care insurance, your costs can vary based on certain factors:

- The maximum amount that a policy will reimburse for services

- The maximum number of days that a policy will ultimately pay

- Any optional benefits

- Your age when you purchase the policy

Call A-1 Home Care Agency and let us provide the personalized care and attention your family deserves. Our Case Managers are on duty 24/7 to answer any questions that you may have regarding Long Term Care Insurance or other services.

Get In Touch!

Subscribe to Our Company Blogs!

Subscribe to our Company Blogs and receive more information about our services, and organization updates! Receive a free Home Care e-book for signing up!